Today’s issue at a glance:

💰 Wealth is freedom, not luxury — Real wealth isn’t about spending, it’s about having control over your time and choices.

🕰️ Time + patience beat intelligence — Compounding rewards those who stay in the game, not those who chase quick wins.

🧠 Behavior matters more than brilliance — Emotional control, discipline, and knowing what’s “enough” are your greatest financial assets.

🚫 Don’t play someone else’s game — Your goals, your risks, your pace. Ignore the noise, avoid lifestyle creep, and stick to your path.

Money advice is everywhere—and most of it is noise. But some lessons? They never expire. These are the principles that hold up through recessions, bull markets, fads, and financial influencers screaming into your feed.

Here are six timeless, deeply human truths about money that will actually change how you think about it (and grow it).

1. Define What Real Wealth Means

"The highest form of wealth is the ability to wake up every morning and say: I can do whatever I want today."

Morgan Housel

Real wealth isn't flashy. It's not in the luxury cars or oversized homes—it’s in the freedom to live life on your terms.

In his book in his book “The Psychology of Money” Morgan Housel says the ultimate purpose of money is to give you control over your time. That’s what financial independence really buys you: peace, choice, and presence.

This is why many millionaires live quietly. The richest people are often the least flashy—because they’re too busy enjoying their time.

2. Let Time and Compounding Do the Heavy Lifting

"We were not in a hurry to get rich. We knew it would happen."

Warren Buffett

The most powerful force in investing isn’t strategy. It’s time.

Warren Buffett’s net worth today exceeds $100 billion. But here's the twist: over $80 billion of that came after his 65th birthday. That’s not because his returns were exceptional (they were great, not magical). It’s because he started investing at age 10 and never stopped. He gave compounding a lifetime to work.

Compare that to Rick Guerin, Buffett's former partner. In the 1970s, Guerin over-leveraged his investments. When the market dipped, margin calls forced him to sell his Berkshire Hathaway shares—cheap. Buffett and Munger, on the other hand, simply waited. They didn't need to be smarter. They just needed to stay in the game.

"Good investing isn’t about earning the highest returns. It’s about earning pretty good returns for the longest period of time."

If you invest $1,000 every year from age 20 at 7% annual returns, you’ll have $210,000 by 60. Start ten years later? You'll have less than half. Compounding rewards the patient, not the perfect.

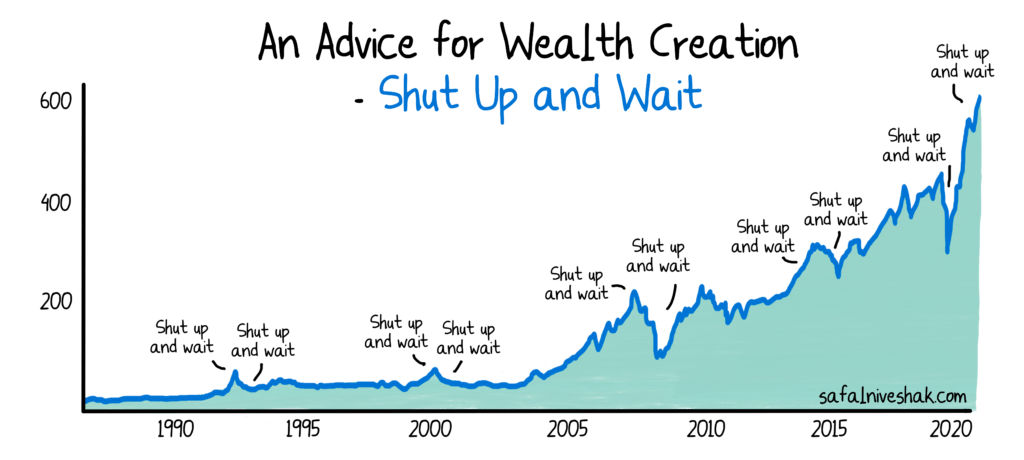

There’s a book called Shut Up and Wait—and it might be the simplest (and smartest) investing book you’ll ever see. Every page features just one graph. No long explanations. No flashy predictions. Just visual proof that patience pays off. It’s a quiet manifesto for long-term thinking in a world obsessed with quick wins. The message? Stop overcomplicating. Start holding. And let time do the heavy lifting.

3. Play Your Own Game—And Stick to It

"Beware taking financial cues from people playing a different game than you are."

A tech startup founder, a retiree, and a 23-year-old crypto trader shouldn’t follow the same playbook. But on social media, it’s easy to forget that.

Your investment decisions should match your goals, timeline, and risk tolerance—not someone else's highlight reel. That’s why understanding your own "game" is essential.

And once you have a plan? Build wiggle room into it:

Assume you’ll be wrong sometimes

Accept volatility as part of the process

Leave margin for error in savings and projections

Because even if you make all the "right" decisions, luck and randomness will still play a role. Bill Gates became the richest man on Earth. His childhood friend and co-founder, Kent Evans, tragically died in an accident. Same path. Different outcome.

"You can do everything right and still end up in a bad spot."

Control what you can. Let go of the rest.

4. Master Your Emotions—Not the Market

"Doing well with money has little to do with how smart you are and a lot to do with how you behave."

We like to think investing is rational. But most money decisions are emotional.

Why do people buy high and sell low? Because fear, envy, and FOMO override logic. Our views on money are shaped less by theory and more by childhood, trauma, media, and culture. As Housel says:

"Your personal experiences with money make up maybe 0.0000001% of what’s happened in the world, but maybe 80% of how you think it works."

So if someone makes a decision you don’t understand, it doesn’t mean it’s irrational. It means they’re playing their own emotional game.

The best investors don’t outsmart the market—they outlast it by mastering themselves.

5. Avoid Lifestyle Creep and Performative Spending

"Spending money to show people how much money you have is the fastest way to have less money."

Lifestyle inflation is sneaky. The more we earn, the more we feel entitled to upgrade—cars, vacations, gadgets, homes. But every upgrade is a trade-off. It’s money that could buy freedom, not things.

Morgan Housel calls this out: "Your ego and your income are enemies."

Just because you can afford something doesn’t mean you should. The millionaire driving a Toyota often has more freedom than the guy leasing a BMW with no savings.

Wealth is what you don’t see: unspent income, long-term investments, and margin for error.

"When you see someone driving a nice car, you rarely think, ‘Wow, that guy is cool.’ Instead, you think, ‘If I had that car people would think I was cool.’"

Real confidence doesn’t flex. It saves.

6. Know What "Enough" Looks Like

"There is no reason to risk what you have and need for what you don’t have and don’t need."

How much is enough?

If you can't answer that, you're in trouble.

Rajat Gupta had wealth, power, and prestige as CEO of McKinsey. But he wanted a seat at the billionaire table. So he took a shortcut: insider trading. He ended up in prison.

Ronald Read was a janitor and gas station attendant. He lived frugally, invested quietly, and died with a $6 million fortune—most of which he gave to charity.

Gupta had more. Read had enough. Guess who died wealthier?

The key to lasting wealth isn’t maximizing returns—it’s minimizing regret. And regret often starts where "enough" ends.

"Enough is realizing that an insatiable appetite for more will push you to the point of regret."

Bottom line?

Money is more emotional than we admit. The rules that actually work aren’t sexy. They’re slow. Quiet. Steady.

But they’re the ones that last.